Ongoing Effects of Covid-19 on US Shipping Operations

This is a guest post by Arslan Hassan.

With the rise of a global pandemic, the world economies are on the verge of fall. By the world economy, we mean the countries that are major contributors to it. The United States is one of them.

The uprise of the pandemic welcomed the closing of borders and ports. Exports and imports hit their lowest in the decade. The development and job creations of the past tens of years fell down a steep graph and governments are now trying to strategize new grounds where they could stand stable.

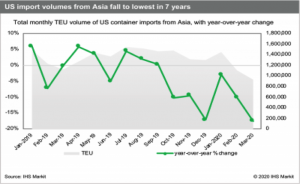

The national retail federation publishes a monthly Global port tracker. According to that, the US imports in the first half of 2020 is likely to decline by 15.1% from the same period last year. Moreover, year over year monthly declines will likely continue over the second half of 2020.

The graph shows the decline in imports from Asia by 17.5% year over year. The decline is driven by an over 40% drop in shipments from China.

Impact of Covid-19 on Shipping Operations

Supply chain logistics is badly affected by covid-19. Orders for merchandise are being canceled or stored in warehouses. On the other hand, imports of medical supplies and other items are pacing up. These items, no doubt, are considered a need during the outbreak.

The global port tracker predicts the largest import drop to occur in May and June. A 17.6% year over year decline in April, 20.1% in May, 21.4% in June, 18.2% in July, and 12.5% in August is predicted.

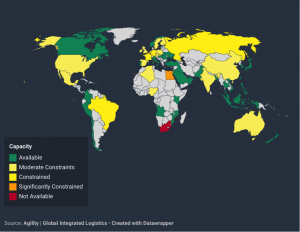

Observer research foundation reported in early April about established trade routes experiencing fewer sailings. The cancellation of Europe-Asia and the US-Asia Pacific routes has caused a drastic drop in capacity. Also in early April 2020, Maersk, a Danish maritime giant warned about the effects of COVID-19 to have serious impacts on earning, especially with its wide exposure to container shipping and port terminals. The company is cutting the Europe-Asia-US route.

Even though most ports are importing normally, a steep decrease in productivity is quite noticeable. That being said, Covid-19 and low container volumes have caused the temporary closure of North American port terminals. Also, fewer containers are being delivered to IPI [Interior Point Intermodal] points in the coming months considering the US and Mexico inland areas are to be most affected. And to top it all off, shortages at Oakland, Seattle, Tacoma, and southeast Florida ports are expected to have the most shortages in equipment balance.

Freight Shipping

In light of limited freight routes, increased demands are going to be expected from US outbound ports to Latin America, Europe, and the Middle East, Agility reports.

USP states that the shipments sent via freight forwarder, Expeditors, and World courier could be impacted by this global health crisis. Further, it suggests separating and ordering RS that require special shipping conditions through commercial transport providers. Which will allow standard shipments of RS to proceed without interruption as their standard carriers are currently operating with very little interruption or restriction.

Among all the depressing news of shipment graphs tracing negative peaks, one thing happened on a positive axis as a reaction of another on a negative one: oil prices.

Crude Oil Prices

The story goes something like this. Late in April, Saudi Arabia and Russia spat over crude production cuts. Russia denied Saudi Arabia’s offer and as a result, the crown prince Muhammad bin Salman declared an oil price war. In short, it crashed the oil prices extremely low, negative even. That’s something that had never happened in history. The oil prices reverberated over -30 USD for quite some days. This provoked sellers to pay to buyers for buying oil. How ironic.

Of course, the Saudis benefited from it because their crude production cost is relatively less than that of the Russians or Americans.

The crashed crude prices skyrocketed the rates for chattering very large crude carriers (VLCCs), peaking approximately 450% higher when compared to March of 2019 for the Middle East to US Gulf routes. The prices shot up significantly from March 6 as oil producers and traders started to inquire into VLCCs holding crude oil temporarily and waiting for the price recovery.

The scenario is unprecedented since, on one hand, crude oil demand has dropped drastically worldwide as industries have come to a near standstill situation. On the other hand, Saudi is preparing to raise its output and push more crude oil cargoes to global refineries, offshore-technology reports. This is something very interesting happening, even historic, in shipment operations. It is something that has never happened before.

It looks to be a large challenge for oil producers and traders to estimate the level of freight rates and holding periods for achieving break even.

Final Thoughts:

- The US and South America exports to Asia will experience vessel capacity shortages from May to July.

- Demands are shooting up from America to Europe and the rest of the world.

- The large crude carriers are facing demands as well, hence increasing their prices

- Some ports like southeast Florida and Seattle are having temporary episodes of closed periods due to equipment shortages.

- Most of the ports are operating normally, however, they are facing decreased productivity.

A positive thought is it’s not a single nation experiencing the pandemic. The whole world is in it together. So if we go down or rise, we do it together. And together shall we come out of this.

This was a guest post by Arslan Hassan.

i like it/ this post is good