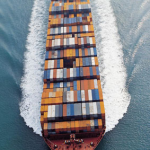

Top 10 Predictions and Trends of Shipping Industry in 2021

This is a guest post by Paul Zhang.

The epidemic made the entirety of 2020 beyond all expectations. Global trade stirred by the “black swan” of the epidemic ushered in a great recession and fell into negative growth.

But for the shipping industry, the situation was quite different. In fact, there have not been many years when the industry has gone from low to high like in 2020. Many shipping companies and freight forwarders have even benefited from misfortune. Rising freight rates brought huge profits to ocean freight carriers. More importantly, the epidemic has accelerated the digital wave in the shipping industry, and some cutting-edge new information technologies have also accelerated the landing speed.

The shipping freight market is currently severely disrupted, especially along Far East routes, due largely to container shortages and imbalances. What is the trend of the shipping industry in the year 2021? Here come 10 predictions.

1. How long will the impact of the epidemic last on trade?

COVID-19 has hitherto unknown global economic and trade implications.

Up to now, the global epidemic situation is still deteriorating, the number of confirmed cases in the United States, Brazil and India is increasing, and the virus mutation has occurred in countries and regions including the United Kingdom.

When the epidemic is not completely under control, its impact on global trade will always exist. Even though some countries and regions have started vaccination, it will take time for the full vaccination to take place.

Whether international trade can salute the dawn in 2021 is still a question.

| [Prediction] Xu Changtai, chief market strategist of Morgan asset management in Asia: The global economic pattern in 2021 will still be dominated by the epidemic. The speed at which governments control the epidemic will largely determine the economic winners and losers in the coming year. Looking forward to 2021, it is expected that the situation will improve and work life will gradually return to normal. The first half of 2021 can be regarded as the starting stage of the new economic cycle, that is, the early growth stage. |

2. Where will the China-US trade war go?

As the global epidemic spread, the United States ushered in a new leadership election, with Joe Biden ultimately defeating incumbent Donald Trump to become the next president of the United States.

So far, the China-US trade war initiated by Trump during his term of office has lasted for two plus years. After Biden’s victory, the outside world is paying attention to his trade policy with China.

Will the trade war continue?

Recently, some media reported that Biden nominated Katherine Tai as the U.S. trade representative and said that he would eventually target China’s improper trade practices. Katherine Tai has previously initiated trade lawsuits against China.

| [Prediction] Professor Shi Yinhong, School of international relations, Renmin University of China: Considering Katherine Tai’s experience in dealing with trade with China, this is another negative signal of China- US relations. The nomination of Katherine Tai may continue Washington’s tough stance on Beijing. |

3. How does China’s shipping industry move forward under the “double cycle”?

In 2020, when facing the complex and severe development situation at home and abroad, China proposes to “gradually form a new development pattern with domestic big circulation as the main body and domestic and international double circulation promoting each other,” which will be an important guiding ideology and starting point for China’s deployment of the 14th five year plan and long-term economic and social development in the future.

For a long time, China’s shipping industry was obviously export-oriented. So what will the shipping industry be like under the new development pattern of “double cycle”?

| [Prediction] Yang Yue, European route analyst of COSCO Shipping Shanghai Co., Ltd: China’s shipping industry still needs the development of globalization under the background of “double circulation.” The internal and external double circulation mode can provide two complementary markets at home and abroad. It will more effectively hedge the risks brought about by changes in internal and external situations under the situation of normalization of epidemic prevention and control. |

4. How long will high freight rates last?

For the entire shipping industry, the most intuitive impact of the epidemic on the market is the continuous surge in freight rates.

At the beginning of 2020, a large number of sailings were withdrawn from shipping lanes based on the pessimistic forecast of the market. However, after the epidemic situation in China was effectively controlled, the freight volume recovered rapidly, driving the main routes’ freight rates to continue to rise. In the follow-up, with the global epidemic out of control and frequent problems such as port congestion, freight rates soared, and the trans-Pacific routes’ freight rates even rose by more than 200% year-on-year.

Traders want freight rates to fall quickly, but so far, the realization of this desire is still far away.

| [Prediction] Rolf Habben Jansen, CEO of Hapag-Lloyd: It is beyond everyone’s expectation this year. Due to the introduction of economic stimulus measures, people spend most of the money on container goods. There are many signs that a strong market will emerge after the Spring Festival and will continue into the second quarter of 2021. Of course, the chaotic market, the lack of berths and the shortage of containers will continue for some time. |

5. How will shipping companies get along with freight forwarders?

Because of the break between DB Schenker and Maersk, how shipping companies and freight forwarders get along with each other has become one of the most concerning topics in the industry.

At present, Maersk’s new strategy is to transform the group into a comprehensive transportation and logistics company. Under this background, it is bound to be part of the traditional freight forwarding business, and thus become a competitor that freight forwarding enterprises cannot avoid.

Freight forwarders face the challenge of liner companies’ development trend of expanding the supply chain and extending service content. How can freight forwarders resist?

| [Prediction] Bao Zhangjing, vice president of China Institute of shipbuilding technology and economy: The industry concentration in the field of container shipping has been very high. The proportion of the transport capacity of the top ten liner companies has increased from less than 60% ten years ago to 83%. Because of this, the strategic focus of the head liner companies will gradually shift from share expansion to value chain expansion (customs declaration, inspection, freight forwarding, and other services). |

6. Is the best time to “buy at the bottom and build a ship” now?

COVID-19 has caused heavy losses to the global economy and the uncertainty of the market has increased. In this context, liner companies were more cautious in operation, and their willingness to order new ships will decline significantly.

However, this situation was broken at the end of 2020, and liner companies including ONE, HPL, and EMC shipping announced their new shipbuilding plans one after another.

Regarding this, some industry analysts believe that the downturn in the shipbuilding industry has led to a decline in ship prices. Therefore, now is the best time to “buy at the bottom” for shipbuilding.

However, there are also views that the current supply and demand situation can not be solved by increasing transport capacity, and more new shipbuilding will have an impact on the follow-up shipping market.

| [Prediction] Olivia Watkins, chief merchant shipping analyst at VesselsValue: According to the new shipbuilding order data of VesselsValue, small container ships with 3,000 teu or below are playing a more and more important role in the regional near ocean routes and are gradually equal with large container ships, becoming the main force of the new shipbuilding market. |

7. When will the shipping industry apply blockchain?

The shipping industry was digitized in an unprecedented manner in 2020. Driven by the digital wave, blockchain has become one of the new directions for the future development of the shipping industry.

Both the industry’s blockchain alliance and the blockchain cooperation platform led by external enterprises are constantly exploring and trying in the fields of documents and customs clearance. At the same time, many blockchain applications are also trying to land in the shipping industry.

How long will it take for blockchain to realize large-scale landing and application in the shipping industry?

| [Prediction] Chen long, head of digital innovation of Maersk Greater China: Segmented supply chains can establish their own “moat” to protect the existing interests in the short term, but the loss of customer experience and supply chain efficiency caused by information asymmetry is an urgent problem for the whole industry. The business remodeling brought by blockchain is not only a technical problem, but also a long-term consideration about the future business model and cooperation model. |

8. Is regional shipping alliances a trend?

After the formation of the 2M, Ocean, and THE alliances, alliance operation has become the main melody of the shipping industry. So far, the advantages of alliance operation are obvious.

However, because the world’s major liner companies have joined the three alliances, does this mean that the industry concentration can only stop here?

The answer is no. By the end of 2020, several major liner companies in South Korea formed the K alliance, which is a regional alliance, but it also gives some enlightenment to other enterprises.

| [Prediction] Gong Jianwei, researcher of International Shipping Research Institute of Shanghai International Shipping Research Center: The competition in the shipping market is no longer a simple fleet competition, but a competition of the overall comprehensive ability of the team with the nature of alliance. Whether it is alliance cooperation within the industry, cross alliance cooperation, or cross-border cooperation with enterprises in different fields, for shipping companies, it will be an effective strategy to ensure an invincible position in the future competition. |

9. What is the fate of PIL?

2020 was not a good year for PIL.

In September, its founder, Zhang Yunzhong, died at the age of 102.

In November 2020, PIL announced that it had entered the full implementation stage of restructuring. At the informal meeting of some bondholders, it announced the details and schedule of the comprehensive restructuring plan, and said that the restructuring plan is the optimal solution for all stakeholders, hoping to get the support of all parties.

In the past two years, the fate of PIL has attracted the attention of the industry. According to the plan, the relevant meeting of PIL will be held in January 2021, which will determine whether PIL can survive the crisis and enjoy peace.

| [Prediction] Zhang Songsheng, managing director of PIL The launch of “financial arrangement agreement” is an important milestone in the restructuring plan of PIL. The plan can ensure that the business of PIL will not be interrupted, maintain smooth operation, and pave the way for new investors to inject funds into the company. |

10. How long does it take for the shipping industry to completely decarbonize?

Although the global epidemic has not been effectively controlled, the shipping industry’s enthusiasm for energy conservation and emission reduction remains unchanged.

At the same time, the goal of total decarbonization of the global shipping industry by 2050 has been put on the agenda again. Some international and regional organizations are also considering supporting corresponding technology research and development by imposing additional carbon emission fees.

However, the world’s major shipping companies, especially the shipowners, have a strong questioning attitude towards the possibility of “decarbonization” of the shipping industry.

| [Prediction] Xin Jicheng, an expert in shipbuilding and marketing: In recent years, the research and development of environmental protection projects invested by the shipping industry is essentially to support the environmental protection research institutions and equipment suppliers in some countries, which has no substantive significance for the comprehensive improvement of the earth’s environment. Compared with the huge investment in research and development of “zero carbon ship,” it seems that the practice of protecting forests and increasing global forest coverage is more practical for improving the current earth environment. |

This was a guest post by Paul Zhang.

Author Bio

Paul Zhang is Founder & CEO of FreightPaul, a digital China forwarder. He was recognized as a top shipping expert with 10 years freight forwarding experience and personally served more than 1200 clients over 100 countries since 2010. Importers like the pretty practical advice and amazing freight tools that Paul shares to simplify their shipping business from China.