Shipping News Roundup – Ship Fees, ILA Ratifies, & Tariffs

In today’s post, we round up three international shipping news stories affecting U.S. importers and exporters…

ILA Ratifies 6-Year Contract

The International Longshoremen’s Association (ILA) ratified its new Master Agreement with the United States Maritime Alliance (USMX), covering dockworkers at East and Gulf Coast ports through 2030. Since the newly ratified contract was tentatively agreed to back in early January, it has been expected to pass the vote of the rank-and-file union members. However, this is still a big moment as it marks the end of a long, contentious on-and-off-again negotiation period that included a three-day strike from the ILA. Technically, the final end will happen when the contract is officially signed. But there’s nothing left to stop that from happening at this point.

Michael Angell reported some details on the contract in a Journal of Commerce (JOC) article:

The ILA highlighted the 62% wage increase as measured against the contract’s top wage tier, equating to an average $4 per hour raise for all dockworkers during the contract’s term. But the contract also includes other wage concessions that mean the lowest-paid longshore workers will receive even larger percentage wage increases.

The starting wage for first-year longshore workers goes from $20 per hour to $27 under the new six-year agreement. By 2026, the starting wage will increase to $30 per hour. The new contract also includes four wage tiers instead of the six under the previous master contract, allowing longshore workers to climb up the pay scale faster.

A marine terminal source familiar with the new contract says that the higher starting wage means a 35% increase for new longshore workers in the first year alone.

Looking at the wage increases, it seems most of the concessions in the final contract came from the employers’ side. However, the USMX did get some movement from the ILA. The union took a hard stance on automation. It wanted no automation. That included no semi-automation. The ILA wanted to move backward from previous agreements it had made on automation in master contracts leading up to this new one. The union was also particularly against rail-mounted gantry cranes (RMGs).

To the ILA, automation is an existential issue. To the USMX, new technology, including some automation, is necessary to keep up with demand. These opposing views on the issue add a high level of difficulty to contract negotiations at the ports.

Ultimately, the USMX and ILA reached an agreement on the issue of automation that both parties could live with. Angell reports in his JOC article:

Under the new agreement, the ILA secured a guarantee that at least one longshore worker will handle each RMG.

However, maritime employers also secured the ability to have RMGs, along with rubber tire gantry cranes, operated remotely, which saves time on shift changes. Marine terminals will also be able to use operator-assistance technology at marine terminals.

USTR Proposes Million-Dollar Fees on Chinese-Made Container Ships Calling at U.S. Ports

This next story has many shippers worried. And not without reason. There are industry experts who believe it could lead to large increases in shipping costs for importers and exporters. However, shippers should temper their fears. I’ll get into why in a minute. In the meantime, the new U.S. Trade Representative, Jamieson Greer, has proposed big fees on Chinese-built ships and ocean freight carriers that utilize Chinese-built ships when they call on U.S. ports.

Gavin van Marle reports in the Loadstar:

…US trade representative (USTR) Jamieson Greer has proposed fees for China-built ships calling at US ports.

At their most extreme, the new fees could amount to $1.5m per ship call for any containerships built in Chinese shipyards, irrespective of the flag the vessel is sailing under or the nationality of its operator.

[A USTR position paper’s] first proposal is that each vessel operated by a Chinese shipping line pays a “service fee” to dock at a US port, of up to $1m per call, or $1,000 per net ton of the vessel’s capacity.The second proposal targets ships built in China, which could pay up to $1.5m per US port call, contingent on how many other Chinese-built vessels the operator deploys.

Carriers with 50% or more of their fleet comprising Chinese-built vessels would be charged up to $1m per vessel call; carriers with 25%-49% would be charged up to $750,000 per call; and those in the 0%-24% band up to $500,000 per call.

The USTR is also targeting the newbuilding sector, and proposes a $1m per call fee on shipping lines having “50% or greater of their vessel orders in Chinese shipyards, or vessels expected to be delivered by Chinese shipyards over the next 24 months”; and suggests a similar sliding scale for carriers with the vessel percentages as above.

Obviously, these fees are no joke. And All-Ways summarized the worries some industry experts have of these fees increasing costs for U.S. shippers well in an email update it sent out:

… industry experts warn of higher costs for importers, potential supply chain disruptions, and trade tensions with China. While some see this as a push for fairer trade, others fear economic fallout. The proposal is open for public comment until March 24, 2025.

That public comment addition is important. It’s one of the reasons I said shippers should temper their fears. Remember, this set of fees is only a proposal. It is not in place. It is under consideration and open to public comment. The odds are it would be amended, refined, or even drastically changed before going into effect. Even before considering the fact that these are far from finally determined fees going into place, their results are speculative.

One mitigating factor for the fees is a refund policy for utilizing American-built ships to go with the fees on Chinese-built ships. Mike Schuler summarizes the remission in a gCaptain article:

Service Fee Remission for Maritime Transport via U.S.-built Vessels:

Operators subject to fees can receive a refund of up to $1,000,000 per U.S. port entrance for using U.S.-built vessels.

The obvious idea is to incentivize ocean freight carriers to move away from Chinese ships, which both the Trump and Biden Administrations found to be propped up by unfair, predatory, and global-trade-threatening maritime practices of China, to American ships. If actually successful, the impact on carriers’ costs would be much less significant than initially thought.

If the proposal goes into effect and is expensive for carriers, they would certainly try to pass costs on to shippers. However, carriers are not always successful in doing so. Historically, carriers have had many problems making surcharges and general rate increases (GRIs), which are are among the most common tools carriers use for passing on costs, stick. Carriers are most successful when they implement such charges in near unison, which I believe happens far too often, even suspiciously so. However, the expense of this proposal would vary from carrier to carrier, and those with less exposure might undercut surcharges used by those with more Chinese-built ships and, thus, facing higher fees.

Carriers may also find ways to utilize their vessel sharing agreements (alliances) to reduce fees they face.

Obviously, the potential implementation of this proposal is one we’ll keep an eye on. It does have potential to affect shippers’ costs, particularly in the short term before carriers with larger percentages of Chinese-built ships, have time to adapt. It may be the proposal is adopted but adjusted to mitigate fees for carriers that start the process of switching from Chinese- to American-built ships. But again, that’s all speculation.

Ultimately, shippers should try not to let this worry them too much until we start to see how the proposal’s implementation, if the Trump Administration decides on its implementation, goes. Still, knowing that there is a possible cost increase in the future is better than being blindsided by it if it does hit

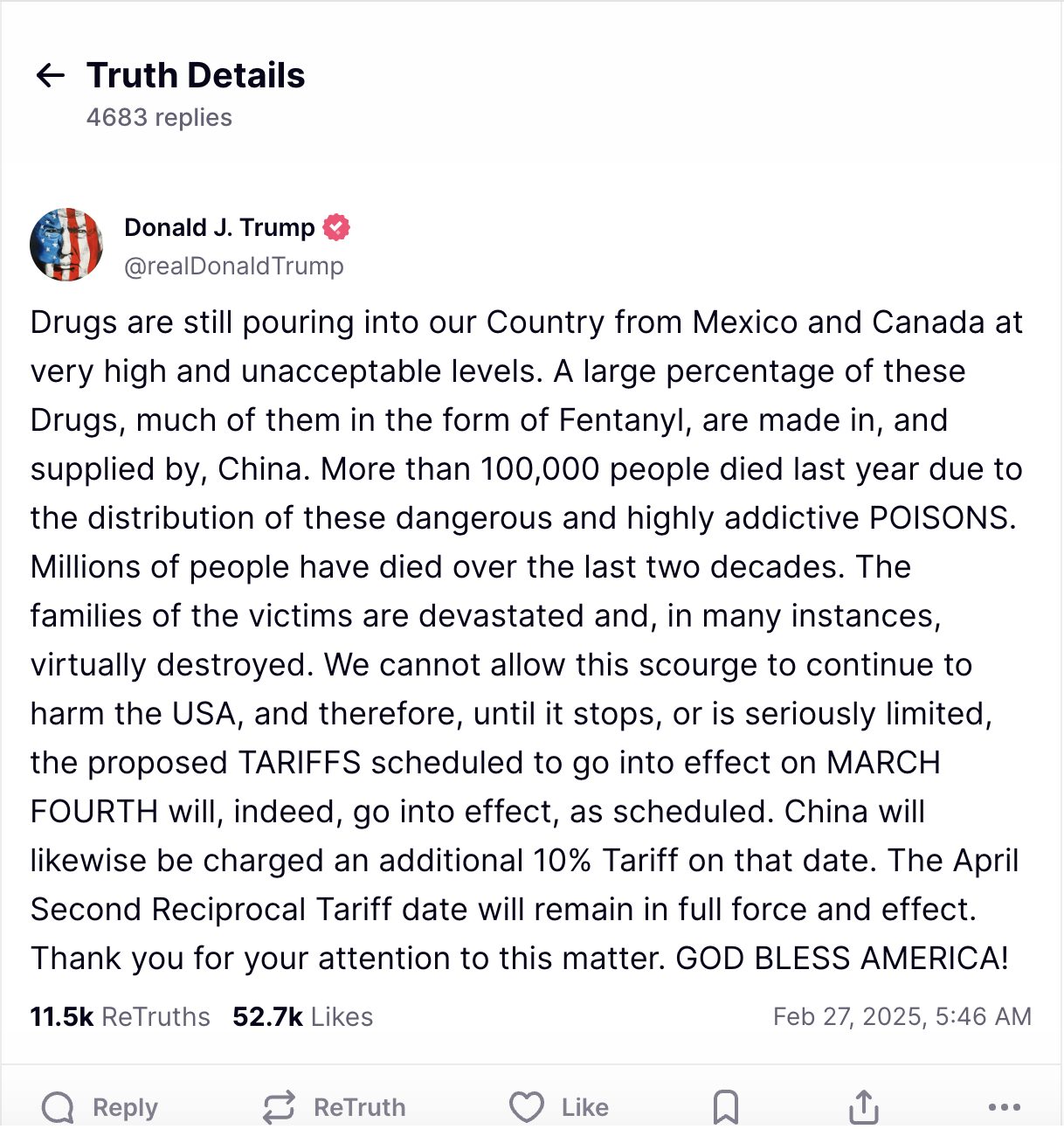

25% Tariffs on Canada and Mexico to Go into Effect on March 4th

The final story we cover is an update on the paused tariffs on imported goods from Canada and Mexico. After negotiating for the countries to increase border security, President Trump paused the 25% tariffs on goods he’d signed an executive order to put in place. Now, via a post on Truth Social, the president announced the pause will not be a cancellation. The tariffs will indeed go into place on March 4th.

President Trump said drugs are still pouring into our country from Mexico and China at very high and unacceptable levels. He added that a large percentage of these drugs are Fentanyl, made in and supplied by China. Along with the 25% tariffs going into place on March 4th, an additional 10% tariff will be placed on goods from China.

In the post, he also mentioned the reciprocal tariffs will still go into place on April 2nd. The reciprocal tariffs are to raise U.S. tariffs on other countries to match whatever tariffs or duties those countries have on U.S. goods.

Here is an image of the president’s post followed by its full text in case you have trouble reading it from the picture:

Drugs are still pouring into our Country from Mexico and Canada at very high and unacceptable levels. A large percentage of these Drugs, much of them in the form of Fentanyl, are made in, and supplied by, China. More than 100,000 people died last year due to the distribution of these dangerous and highly addictive POISONS. Millions of people have died over the last two decades. The families of the victims are devastated and, in many instances, virtually destroyed. We cannot allow this scourge to continue to harm the USA, and therefore, until it stops, or is seriously limited, the proposed TARIFFS scheduled to go into effect on MARCH FOURTH will, indeed, go into effect, as scheduled. China will likewise be charged an additional 10% Tariff on that date. The April Second Reciprocal Tariff date will remain in full force and effect. Thank you for your attention to this matter. GOD BLESS AMERICA!