Movies Over But Hunger Games of the Sea Continue w/ Merger & Buyout

Almost two years ago, I posted Hunger Games of the Sea, a blog about all the carrier alliances that were forming as international shipping companies struggled for dominance and just to stay alive.

I wrote back then that as the games for international shipping supremacy play out, it seems unlikely that all the carriers on the arena of the oceans will survive. And we’ve watched the competition pool of shipping container carriers shrink since then with alliances and mergers.

It seems only fitting that as the last installment of the Hunger Games movies dominates the box office (until Star Wars comes out this weekend) that we see more big moves in the Hunger Games of the Sea.

There are two big news items in terms of the ever shrinking carrier competition:

1. COSCO and China Shipping Merging

2. CMA CGM Buying Out Neptune Orient Lines

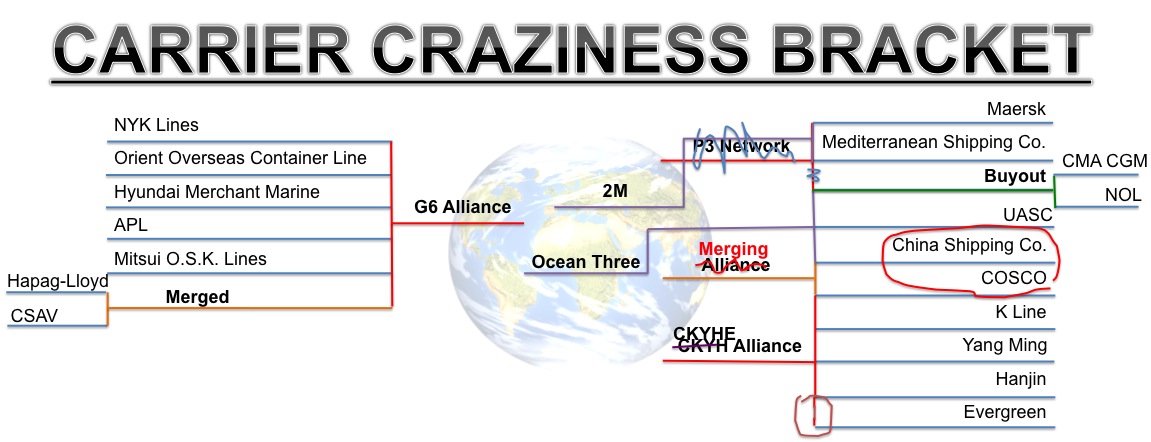

Let’s look at both individually, but first… Those of you who read this blog regularly guessed it… Let’s check out the updated Carrier Craziness Bracket!

1. Cosco and China Shipping Merging

China Ocean Shipping (Group) Co. [COSCO] and China Shipping (Group) Co. are the two giant shipping companies of China. Both have struggled to be profitable, as have carriers throughout the international shipping industry, but have been greatly aided by Chinese government subsidies.

A merger between these two shipping companies has been on the horizon for a while as China has been working to reform many state-owned businesses, like COSCO and China Shipping, to create bigger, stronger, more efficient companies that are more competitive on a national level.

That being said, it comes as no surprise that on Friday, China’s State Cabinet approved the merger between COSCO and China Shipping.

The Wall Street Journal reported the following details of the merger:

China Cosco Holdings Co. said in an exchange filling that it plans to consolidate the container-shipping operations with its state-backed rival China Shipping Container Lines Co. through acquiring a total of 33 container-shipping related units and affiliates from CSCL for 1.14 billion yuan ($177 million) and leasing its container ships.

Meanwhile, the Hong Kong and Shanghai-listed flagship of Cosco Group plans to sell all its dry-bulk shipping businesses to its state parent for 6.77 billion yuan.

The asset restructuring also covers the two groups’ ports and oil-tanker-shipping operations. Cosco Pacific Ltd., the Hong Kong-listed port-operating arm of Cosco Group will pay 7.63 billion yuan to buy the port-operating business of China Shipping (Group) Co. Cosco Pacific also plans to sell its container leasing business—Florens Container Holdings Ltd.—to a unit of China Shipping Container Lines Co. for 7.78 billion yuan.

China Shipping Development Co., the oil-and-bulk-shipping unit of China Shipping Group, also plans to buy the oil shipping business from China Cosco Group, it said.

The merging of COSCO and China Shipping will create the world’s fourth largest shipping company, leaving only Maersk, MSC, and CMA CGM as bigger carriers.

An interesting thing to watch is how this merger will affect alliances. Looking at the Carrier Craziness Bracket above, you can see this merger smushes two alliances together like a s’more with the newly merged Chinese shipping company acting as the marshmallow.

China Shipping is part of the Ocean Three Alliance and COSCO is part of the CKYHE Alliance. Can one company be part of both of these major alliances? Will that affect the international approval of these two alliances?

The merger itself will also need international approval. The way this merger plays into the alliances may give national agencies more to consider when deciding whether or not to approve.

2. CMA CGM Buying Out Neptune Orient Lines

CMA CGM is already the world’s third largest international shipping carrier, but that’s not stopping it from getting bigger.

CMA CGM made a deal to buy Neptune Orient Lines (NOL), and then swung a surprise.

Last week, the New York Times reported CMA CGM made a deal to buy NOL for $2.4 billion, excluding debt.

Then, according to the Straits Times, CMA CGM swooped in on the open market and bought up shares at a discount of the offered buyout price:

On Dec 11, CMA CGM bought about 3.68 million NOL shares on the open market at S$1.22 per share. The shares purchased make up 0.14 per cent of NOL’s issued share capital, they said.

The purchase price is at a 6 per cent discount to CMA CGM’s offer…

The total number of shares now owned, controlled or agreed to be acquired by CMA CGM is 10.8 million.

…

Temasek Holdings, which owns 67 per cent, agreed to sell its shares.

Conclusion

It’s clear that the strategy of carriers is to control the largest amount of market share in international shipping as possible.

While the Hunger Games epic has reached its conclusion, the carriers’ games for dominance and survival on the sea of international shipping is far from over. And, of course, Universal Cargo will be keeping an eye on how the carriers’ game continues to play out.

Continued Reading

Here’s a collection of blogs and articles we’ve posted on it so far.

How Will Carrier Alliances Behave in the 2015 Shipping Market?

Carrier Alliances’ Impact on 2015 International Shipping

CMA CGM Forms Ocean Three Alliance with UASC & China Shipping

Here We Go Again — FMC Approves 2M Vessel Sharing Agreement

Maersk & MSC Replace P3 Network with 2M Vessel Sharing Agreement

Shipping Industry Fallout from the Failed P3 Network

Shipping News Alert: P3 Halted by China

Carrier Craziness Bracket! International Shipping Alliance Overview

Watch Out International Shipping Competition: FMC Approved P3 Network

Carving Carrier Competition: Cosco & China Shipping Form Alliance

![]()

Source: UC Blog