Here Comes China Cosco Shipping Corporation, Shipping Leviathan

It’s not as catchy as, “Heeere’s Johnny!” But here comes China Cosco Shipping Corporation Limited, the result of the merger between China Cosco Group and China Shipping Group. According to Seatrade-Maritime, the new shipping giant “will be officially opened in Shanghai on 18 February.”

It’s not as catchy as, “Heeere’s Johnny!” But here comes China Cosco Shipping Corporation Limited, the result of the merger between China Cosco Group and China Shipping Group. According to Seatrade-Maritime, the new shipping giant “will be officially opened in Shanghai on 18 February.”

This comes after the merging companies reported the People’s Republic of China’s Anti-Monopoly Bureau of the Ministry of Commerce “granted its approval of anti-trust filing for concentrations of undertakings in relation to its transactions under this material asset restructuring which involves the acquisitions of equity interests in 34 companies such as China Shipping Container Lines Dalian Co., Ltd. and China Shipping Ports Development Co., Limited.” —World News Report.

Phew.

Let’s just say China Cosco Shipping Corp is a big company.

How big?

The Wall Street Journal calls it a “shipping leviathan”.

For those of you unfamiliar with the leviathan, it’s described in the 41st chapter of the Biblical book of Job:

“Can you pull in Leviathan with a fishhook

or tie down its tongue with a rope?

Can you put a cord through its nose

or pierce its jaw with a hook?

…

Can you fill its hide with harpoons

or its head with fishing spears?

If you lay a hand on it,

you will remember the struggle and never do it again!

Any hope of subduing it is false;

the mere sight of it is overpowering.

…

Nothing on earth is its equal—

a creature without fear.

It looks down on all that are haughty;

it is king over all that are proud.”

It seems that going back before the invention of the shipping container, Denmark’s A.P. Møller Maersk has reigned as the world’s largest shipping company. But now China Cosco Shipping (I seem to be chopping off one more piece of the name every time I type it) is challenging for the title of world’s largest shipping company.

In terms of ship value, China Cosco Shipping has surpassed Maersk as the largest shipping company, according to the Wall Street Journal article that called the new company a leviathan:

The new Chinese company will own a total fleet of 832 vessels, including container ships, dry-bulk ships and tankers, valued at roughly $22 billion. In comparison, A.P. Møller Maersk’s Maersk Line owns 262 container ships valued at $12.3 billion, according to data provider VesselsValue.com, which doesn’t track chartered ships.

Maersk does still lead in terms of shipping container capacity:

In terms of container capacity alone, Maersk Line’s 262 ships keep it in first place, with a capacity of about two million containers. China Cosco Shipping will be second, with 209 ships and a capacity of 1.6 million containers.

It is not surprising that the Anti-Monopoly Bureau of the Ministry of Commerce approved the merging of these companies and the creation of this giant sea creature. After all, China’s government did push for the state-owned shipping companies to merge in the first place.

What will be interesting is whether or not the merger that combines China Shipping Group and COSCO will get approval from regulators around the world, particularly from the ones of the U.S. and Europe.

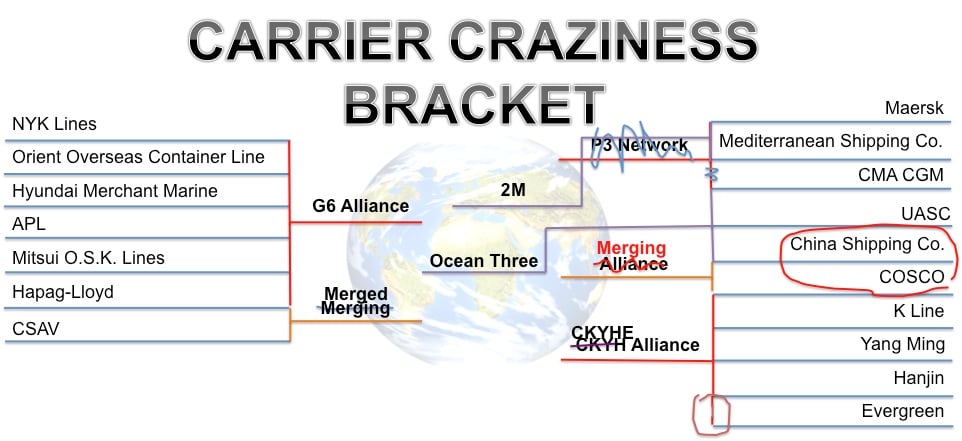

Where things get really complicated is when it comes to carrier alliances. That’s right, I’m busting out my Carrier Craziness Bracket!

The original Chinese shipping containers were part of two major, but of course separate, alliances that share ship operations to reduce costs.

You can see which carriers are working with which carriers in the Carrier Craziness Bracket above. China Shipping belongs to the Ocean Three alliance with CMA CGM and UASC. COSCO belongs to the CKYHE Alliance.

These alliances had to go through approval processes with regulators around the world. All of the alliances are being carefully monitored, with the risk of their approval being revoked.

Would regulators allow one major shipping company to belong to two different major alliances? Would quitting just one of these alliances be enough? After the merger, China Cosco Shipping is such a larger carrier than either of the original two Chinese shipping companies were before. That new size would affect the dynamics of the carrier alliances it belongs to.

It seems a shake up in alliances will follow this merger. Perhaps, a whole new alliance will be formed with China Cosco Shipping. Exactly which other carriers would join the alliance can’t be known.

There are many questions this merger raises:

Will it inspire more shipping company mergers? How will shippers respond to the loss of competition between two major Chinese shipping companies? Will this affect freight rate pricing? Will this create more opportunity for non-Chinese shipping companies to land Chinese shippers as clients?

All of this will be worth watching in the months ahead.

![]()

Source: UC Blog