Is the US Economy in Trouble or Gaining Recovery Momentum?

International Monetary Fund Managing Director Christine Lagarde said recovery from the 2007-2009 global financial crisis “remains too slow, too fragile and risks to its durability are increasing,” according to a Reuters article on Fortune.com.

International Monetary Fund Managing Director Christine Lagarde said recovery from the 2007-2009 global financial crisis “remains too slow, too fragile and risks to its durability are increasing,” according to a Reuters article on Fortune.com.

“Let me be clear: we are on alert, not alarm. There has been a loss of growth momentum,” Lagarde said in her prepared remarks.

This was in a speech Tuesday at Frankfurt’s Goethe University.

The article actually states that “the U.S. recovery has been gaining momentum.” However, President at Money Strong, LLC and Former Advisor, Federal Reserve Bank of Dallas Danielle DiMartino Booth asks and answers the title question, “Is America’s Economy Shooting Blanks?” with a less optimistic opinion in an article she wrote.

In the article, she says:

If only our economy had more growth industries. We’ve just learned that the economy grew by 1.4 percent in the final three months of last year. The sad thing is that’s a vast improvement over the last figure we had in hand of 1.0 percent. For the full year, the economy grew at a 2.4 percent rate, the same paltry pace it has since the recession ended in 2009.

I saw the words “vast improvement” in there; maybe she is seeing momentum from the U.S. economy. Well, if you couldn’t tell Booth is not pointing out growth momentum, her article ends with a clear answer to the question posed by its title:

In other words, the U.S. economy is desperately lacking in growth industries and will continue shooting blanks until that changes.

But that’s just one article by one person. True, but you don’t have to look hard to find others.

There’s an entire article on Time.com dedicated to answering the question, “Why hasn’t America’s economy recovered more robustly?”

In this article, there seems to be an opposite assumption than the U.S. recovery is gaining momentum as the Reuters article on Fortune makes. In fact, the Time article goes into great detail to unpack the economic theory of “secular stagnation” to explain why the U.S. economy might never get better.

Yikes.

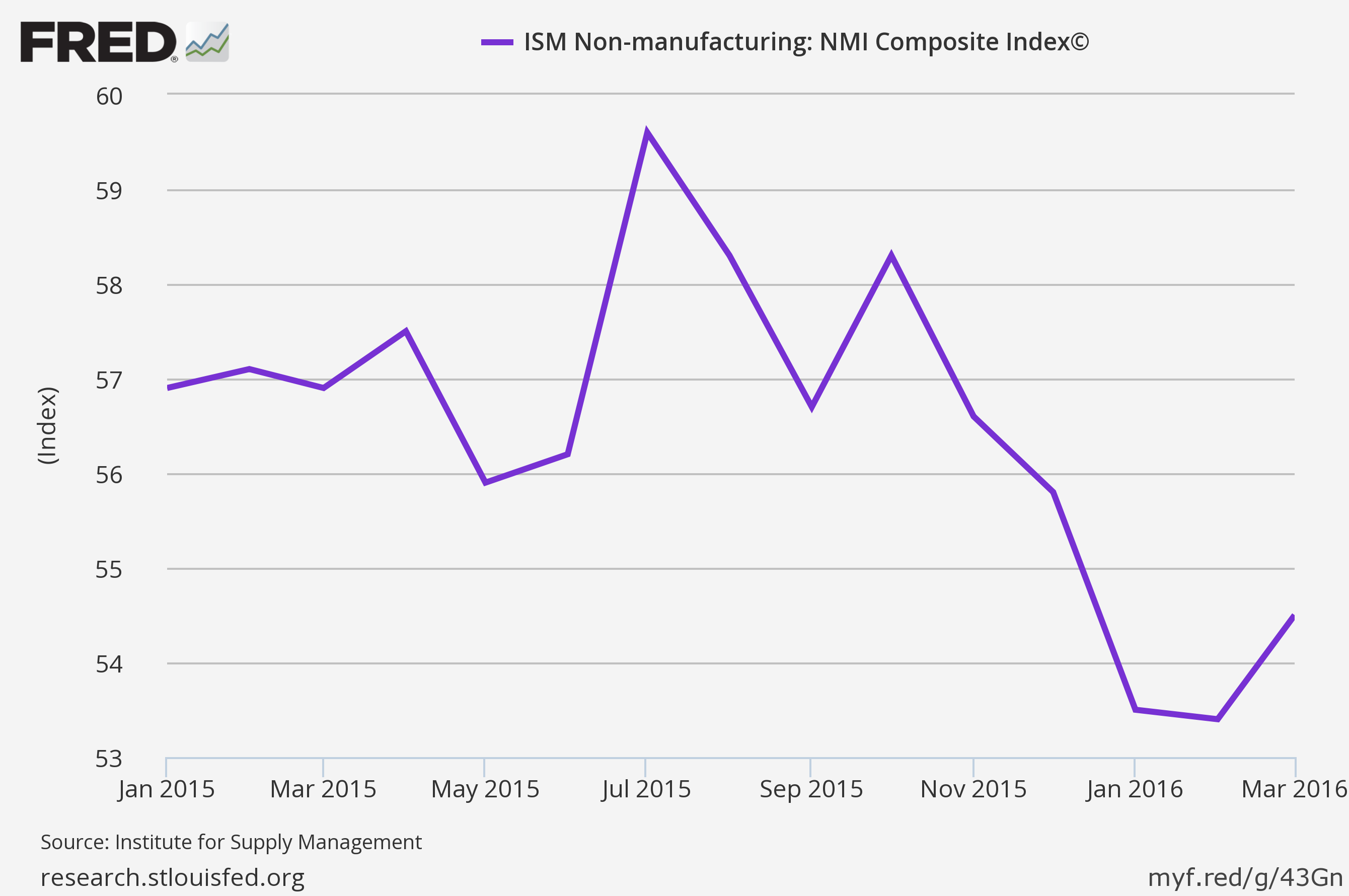

Of course, there are articles hitting the web as I write this about how the economy is rebounding because the Institute for Supply Management (ISM) just released a services sector index that shows an increase in March to 54.5 from 53.4 in February.

Numbers above 50 indicate growth in a sector, so this is good right?

Sam Ro goes so far as to call this “proof the US economy is stronger than you think” in a Yahoo! article with those words in the headline.

I don’t know what you think, but “proof” is a stronger word than I think should be used here. But what I really love is how CT Post calls this a comeback of the most important part of the U.S. economy when it is the first increase for the services sector’s index in five months.

CT Post’s article even shared this graph to make us all feel really good about that uptick at the end (and bottom) of the chart.

There are always many people to disagree about the state of the economy, so the Reuters’ Fortune article is allowed to say the U.S. economic recovery is gaining momentum.

As the article stated this, it reported recommendations IMF’s managing director made for US policymakers to implement:

A higher minimum wage, expanded tax credits for the working poor and improved family leave benefits – changes championed by President Barack Obama and Democratic Party presidential candidates – could help increase the U.S. labor force, she said.

Republican lawmakers who control the U.S. Congress, however, have blocked these proposals from advancing.

It’s not surprising Christine Lagarde comments and/or the reporting of them would take a political turn with the 2016 election and world leaders about to converge on Washington, as the article states:

Her remarks come less than two weeks before senior ministers, central bankers and other policymakers from the Fund’s 188 member countries gather in Washington for the IMF and World Bank Spring Meetings to assess the health of the world economy.

Of course, with the recent economic news coming out of China, and all its interconnectedness to countries around the world, European market drops, the bailout of Greece, etc, the US is certainly not the only place with economic uncertainty.

What are your thoughts on the US and world economies? Are we gaining recovery momentum or are we moving in the wrong direction?

![]()

Source: UC Blog