Peak-Season Freight Surcharges Hit NVOCCs as BCOs Sail Smoothly

After a year of exceptionally low freight rates where ocean carriers lost billions in 2011 largely due to overcapacity, they have spent 2012 working on raising rates for ocean freight in 2012.

On the popular trade routes from Asia to the U.S. West Coast, general rate increases have especially been felt. But these freight rate increases have not been felt equally across the market. Those feeling the freight rate increases most acutely are non-vessel operating common carriers (NVOCCs).

A recent Journal of Commerce (JOC) article calls the current situation a “two-tier pricing market”. The article sources Alphaliner with saying NVOCCs are paying $600 to $1,000 more than beneficial cargo owners (BCOs) on a 40-foot container shipment from Asia to the U.S. West Coast.

Since January of 2012, carriers have imposed a series of general rate increases that have raised ocean freight rates from Asia to the West Coast of the U.S. from around $1,400 in December of 2011 to around $2,700 here in June of 2012.

Traditionally, summer peak-season rate increases from ocean carriers are common. Rates rise for NVOCCs, but BCOs are often protected by contracts that include clauses which prohibited peak-season surcharges.

BCOs are able to sign contracts directly with carriers pledging to ship certain quantities of goods while receiving a steady, discounted price throughout the year. Often this means spot rates will fall below BCO rates per FEU part of the year, but be more expensive than BCOs pay during peak-seasons.

But many NVOCCs are unhappy with the current two-tier market, saying the $600 to $1,000 discrepency between BCO and NVOCC rates is too large.

NVOCCs really are the ones feeling the brunt of the carriers’ current rate increases.

“This has directly impacted our business. It’s a life or death situation,” Stephen Aldridge, president of an NVOCC is quoted as saying about the situation in an IDS article titled NVOs Take Brunt of Peak-Season Surcharges.

“They’re targeting the 3PL/NVO community,” Aldridge is also quoted as saying.

Tension is not uncommon between carriers and NVOCCs. While NVOCCs may complain about rate increases, some carriers complain that NVOCCs play carriers against each other to force down freight rates.

The IDS article goes as far as saying the normal response of carriers to rate increase complaints from NVOCCs is, “Let them build a ship.”

While it is wider than normal, a “two-tiered market” between ocean freight rates carriers charge NVOCCs and BCOs during peak-seasons is not uncommon. While NVOCCs may be seeing higher rates than what they like, changes are never too far away in the volatile market of ocean freight shipping.

![]()

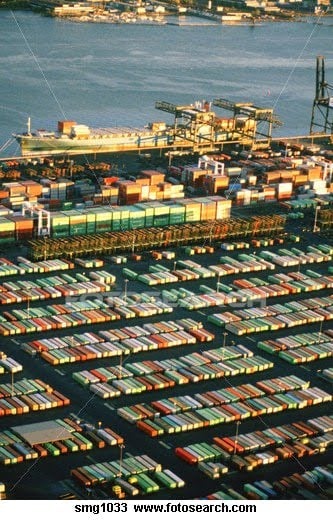

Source: Shipping