The Carrier Craziness Bracket is back!

When China’s Ministry of Commerce halted the P3 Network back in June, it busted my Carrier Craziness Bracket faster than upsets and choosing my alma mater, Western Michigan University to advance in the NCAA Tournament wrecked my March Madness bracket.

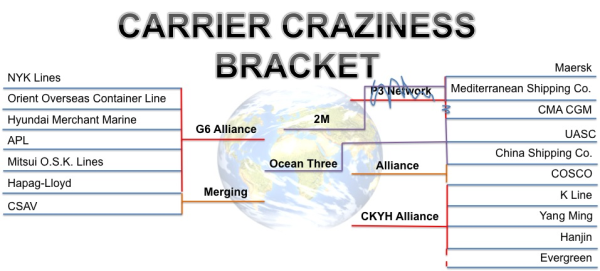

New developments in carrier alliances have lent to an updated Carrier Craziness Bracket which maps out the carrier alliance situation in international shipping:

The Carrier Craziness Bracket is all about shipping lines forming alliances (or even merging), a trend that began after carriers suffered losses in the billions of dollars when the global recession hit. To increase efficiency, market share, profits, and just plain survive, alliance after alliance has been formed between carriers.

The biggest and baddest of the alliances was the P3 Network between the three largest shipping companies in the world: Maersk, MSC, and CMA CGM. Many feared what this alliance would do to competition in international shipping, but China put those fears to bed by vetoing the alliance.

It didn’t take long for Maersk and MSC to respond with a new vessel sharing agreement called the 2M. You can read all about the 2M agreement replacing the P3 Network here.

Upon the 2M Vessel Sharing Agreement’s announcement, CMA CGM–the smallest of the “big 3” shipping companies–appeared to be the odd man out. But would you really expect CMA CGM to sit back and do nothing?

On Monday, CMA CGM announced signing 3 agreements that amount to a service-sharing alliance with China Shipping Container Lines Co Ltd (China Shipping Co. in the Carrier Craziness Bracket) and United Arab Shipping Co (UASC). This new alliance is called the Ocean Three.

Here are the details CMA CGM laid out on Monday, September 8th:

Under the name of OCEAN THREE, the agreements concern the following maritime trades: Asia-Europe, Asia-Mediterranean, Transpacific and Asia-United States East Coast.

The agreements (a combination of Vessel Sharing Agreements, Slot Exchange Agreements and Slot Charter Agreements) will complete the CMA CGM offering on the biggest global maritime markets:

- On the Asia-Europe trade: 4 weekly services, which complete the 2 existing services, thereby offering 6 departures per week

- On the Asia-Mediterranean trade: 4 weekly services, 2 to the Mediterranean, 1 to the Adriatic and 1 to the Black Sea the only one on this market

- On the Transpacific: 4 weekly services to California and 1 service to the Pacific Northwest (United States and Canada)

- On the Asia-US East Coast trade: 1 service via the Suez Canal and 1 service dedicated to the Gulf of Mexico.

- The agreements on the Transatlantic trade are being finalized and will soon be announced.

This new offering will combine both speed and reliability. Rotations will be optimized with calls in all the biggest Asian, European and North American ports, using transshipment hubs common to the three partners.

The number of weekly calls proposed and the transit times will be among the best on the market, thereby responding to the expectations of our clients.

CMA CGM followed with an update that included the following key highlights of the Ocean Three on Tuesday, September 9th:

Key Highlights:

3 Main Trades

17 Fixed-day weekly loops

159 Vessels

1,5 Million TEU capacity

199 Weekly calls

93 Ports of call

The Ocean Three will require approval from the Federal Maritime Commission (FMC). Since the FMC approved the P3 Network between the three largest shipping companies, it is likely the Ocean Three will also receive approval with the largest of the three participating shipping companies being only the world’s third largest carrier.

Coming in at the fourth largest shipping line company is Hapag-Lloyd if its merger with Compania SudAmericana de Vapores (CSAV) makes it through approval.

According to Reuters and their sources, Hapag-Lloyd and CSAV “will win conditional European Union approval for their merger…” Approval from the U.S. has already been granted.

*This just in (9/11/14): European Union has approved Hapag-Lloyd and CSAV Merger. Approval pending in a few other jurisdictions.*

Of course, if the Hapag Lloyd merger or Ocean Three agreements get halted by regulatory authorities, I’ll be ready to scribble more on the Carrier Craziness Bracket.

RELATED BLOGS – HUNGER GAMES OF THE SEA TRILOGY: