Which Carriers Will Be the Final 3 to Survive?

Last month, Maersk said it expects carrier competition to shrink to only three global companies.

It’s possible that Maersk is wrong, but it’s hard not to take the words and predictions of the clear leader in international shipping seriously. Naturally, that begs the question:

Which carriers will be the final three?

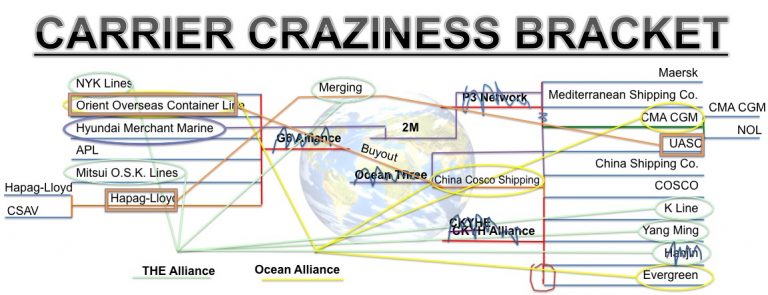

For the last few years, we’ve been watching competition shrink between carriers as shipping lines have been swallowed up by buyouts, mergers, and even bankruptcy with the remaining carriers banding together in alliances.

All it takes is one look at Universal Cargo’s Carrier Craziness Bracket to see just how intensely insane carrier competition has become.

It’s hard to imagine that when the bracket was first created, it was a clean chart of the carriers dividing into alliances.

If Maersk is right, there are a lot of international shipping company names on the above bracket that will disappear.

So let’s take a stab at which carriers are the most likely to be the final three. This really does feel like March Madness, which is what inspired the Carrier Craziness Bracket in the first place.

Maersk is the obvious top choice to survive.

All the way back in 2011, we posted a blog with a headline that read, “Maersk to Outlast Competitors in Face of Lower Freight Rates?”

The gist of that article was overcapacity is creating lower freight rates and Maersk said it was prepared to outlast its competitors, who weren’t as well prepared to survive the plummeting profits. We called Maersk the big dog of international shipping that likely would survive the dog eat dog world of international shipping that was developing.

As the years past since 2011, overcapacity remained and, as mentioned, quite a few carriers have been eaten with Maersk remaining the clear leader in the industry.

There’s no reason to think Maersk’s status will change, barring some catastrophe. According to a Mike Wackett penned article in the Loadstar, Maersk has even managed to stay in profit despite the huge cyber attack that hit the world’s largest carrier by capacity in June.

So we have Maersk in the final three. That only leaves two spots.

Just like in March Madness, it’s easier to pick carriers most likely to get eliminated than the ones likely to make it all the way. For example, if this was March Madness, Yang Ming, with all its recent financial struggles, would certainly be a 16 seed.

There are plenty who worry about Yang Ming being the next Hanjin, forcing the carrier to reassure customers about its financial recovery. If carrier competition shrinks all the way down to three global companies, it’s hard to imagine Yang Ming being one of them.

However, there are a number of companies at the top that it’s hard to imagine won’t be in the picture of ocean shipping’s carrier competition pool.

That being said, also like in March Madness, I see four one seeds among the carriers at the top. After Maersk, the number one overall seed, are the Mediterranean Shipping Company (MSC), Ocean Network Express (ONE), and China Cosco Shipping Corporation Limited (COSCO) as the other one seeds.

Predicting only three global companies in the international shipping industry means one of these one seeds must go out of business, merge into one of the others, get acquired, or downsize to a domestic shipping line.

I’m picking COSCO as one of the final three.

It’s hard to imagine China allowing its shipping company, which it strengthened by merging the country’s two large shipping companies China Cosco Group and China Shipping Group, to fall out of the picture.

On top of that, Mark Edward Nero just reported in the Loadstar that after its acquisition of Orient Overseas International Ltd. (OOCL), COSCO is set to become the world’s third largest carrier by capacity:

Chinese government-owned ocean carrier COSCO Shipping could hit a total fleet capacity of 3 million TEUs by the end of 2018, which would vault it into the third spot in the global liner rankings, surpassing France’s CMA CGM, according to a new report by container analyst Alphaliner.

I didn’t even list CMA CGM, currently the world’s third largest carrier by capacity, as one of the four one seeds. CMA CGM is a strong two seed. Despite its size, I think it will end up with the short end of the stick if only three remain just like it did when the P3 Network was blocked by China.

The P3 Network was set to be a huge alliance between the three largest carriers in the world, Maersk, MSC, and CMA CGM. CMA CGM ended up with that short end of the stick as Maersk and MSC formed the 2M Alliance when China refused to approve the P3, forcing CMA CGM to scramble to find new alliances.

MSC’s alliance with Maersk, along with its size gives it an edge over CMA CGM. But does MSC also have an edge over ONE?

ONE is the entity that Japan’s big three international shipping companies, Kawasaki Kisen Kaisha, Ltd. (K Line), Mitsui O.S.K. Lines, Ltd. (MOL), and Nippon Yusen Kabushiki Kaisha (NYK), are merging into.

Originally, I was going to make ONE one of the final three because of the financial surge and stock increases K Line, MOL, and NYK have seen since the announced merger and Japan being protective of it like China is of COSCO, with MSC perhaps eventually becoming one with Maersk through a buyout or merger.

However, I think COSCO has the stronger chance of being the final global carrier coming out of Asia, while ONE could become more of a domestic carrier, handling Japan’s shipping needs.

That makes my projection of the final three:

- Maersk

- MSC

- COSCO

My hope is the industry does not see carrier competition shrink to that level. And I certainly wouldn’t think more of my opinion than the experts at Maersk, but I would think it more likely for the competition pool to shrink to four or five rather than three global companies.

What are your thoughts? Do you agree? Disagree?

Which carriers would you pick as the final three standing?

Let us know in the comments section below.

Jared, a couple of issues. First, focus on the word “global”, look at the numbers of vessels the carriers have or operate and

see who has the ability, absent Alliances, to be global. Maersk with over 700 when considering the order book and acquisition of Hamburg Sud. MSC

is next with far fewer vessels but enough to be global.

Cosco with the Chinese government pouring $26. Billion between last year and 2020 can be as big as they want. With the recent ordering of 20 vessels they will be the same size as MSC by 2020

ONE, much smaller than you might expect, by 2020 they will be 36% of the size of Maersk. CMA will be 40% larger than ONE, but

CMA is under a heavy debt burden and in my opinion someone who may be bought out or merged.

The top 10 are so top heavy the numbers 7-10 combined will be smaller than Maersk in 2020. The 10th largest will be 1/8th the size of Maersk .

My 3 is likely the same as yours; I don’t see ONE emerging in the top 3 but they will be around. Same with the Koreans, for the same

reason as ONE – market protection. Same can be said for Taiwan. I think European nations are comfortable with the current situation and know that

between Maersk, MSC and CMA if they survive, Europe is market protected.

Maersk and MSC merging? My instinct is to say NO. MSC is a very “family” oriented company in more ways than one. And they are heavily invested

in their cruise line. They have always been a mystery relative to access to capital, but regardless, they have emerged as a huge player and have hedged their bets with terminals and the cruise line. The only thing suggesting a merge with Maersk is the similarity of how Maersk purchased Sea-Land; first a joint service with a true combined operation BUT with a CSX ownership of Sea-Land that had many problems and used Sea-Land as an

excuse as to why the stock price was so volatile. But in the end CSX sold Sea-Land for a virtual song, eventually paying less than $825.Million. What a bargain in today’s world. So is AP Moller trying the same tactic, be in a joint service for several years and then buy the partner? I see huge problems with this happening in several countries, China being first. And MSC is not in the situation CSX was.

Interesting speculation.