Shipping Industry Fallout from the Failed P3 Network

I’ll miss you, P3 Network, if only for your ability to give me a dependable topic to write blogs about (the P3 Network was prominently featured in at least 10 blogs here on the UCM website).

When Maersk, Mediterranean Shipping Co. (MSC), and CMA CGM announced their plans to form an operational alliance, it made huge waves in the world of ocean shipping. Yesterday we dropped a short Shipping News Alert to let our customers and blog readers know that China did not approve the alliance and the P3 Network was stopped before it began.

When Maersk, Mediterranean Shipping Co. (MSC), and CMA CGM announced their plans to form an operational alliance, it made huge waves in the world of ocean shipping. Yesterday we dropped a short Shipping News Alert to let our customers and blog readers know that China did not approve the alliance and the P3 Network was stopped before it began.

But that does not mean the P3 Network has not had an effect on the international shipping industry.

The P3 Network’s waves, even though the P3 Network never came to fruition, splash and ripple across the international shipping industry. This blog looks at the fallout from the alliance as a final farewell to the P3 Network before the search for a new frontier of international shipping blog topics begins.

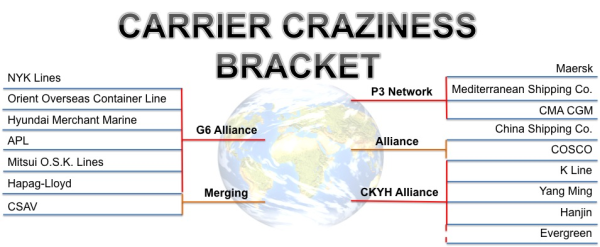

China halting the P3 Network means I have to throw away my Carrier Craziness bracket just like I had to throw away my March Madness bracket. Because that’s my luck with brackets, I didn’t even bother to fill out a World Cup bracket.

Despite P3’s demise messing up my bracket, the bracket is a reminder of the effect P3 had on the industry.

Despite P3’s demise messing up my bracket, the bracket is a reminder of the effect P3 had on the industry.

When the three largest carriers announced they were forming an operational alliance, other major carriers went to work strengthening their positions. The way they went about strengthening their positions included strengthening existing alliances or even merging with another carrier.

Hapag-Lloyd and CSAV merged, jumping them to the 4th largest carrier. Cosco and China Shipping Co. formed an alliance. The G6 Alliance went about expanding their alliance. Finally, the CKYH Alliance invited Evergreen in as a full, official member (Evergreen had cooperated with the CKYH Alliance on occasion in the past).

So while the P3 Alliance is not going forward, the competition of the three largest shipping carrier lines has strengthened.

More important for most of our readers is the question of how will China blocking the P3 Network affect things for shippers. Is this a good thing for freight rates?

Worries about the P3 Alliance were that the Big 3 carrier lines would have too much control and all the shrinking of competition between ocean carriers through alliances and mergers would result in higher freight rates.

In the short run, the P3 Alliance carriers could have driven down freight rates with their increased efficiency and lowered operational costs of the alliance to push competition out of the market. In the long run, fewer competing international shipping companies would increase freight rates.

Now that the P3 Alliance has been stopped by China, Maersk, MSC, and CMA CGM will have more pressure to bring freight rates up to be profitable while dealing with higher capacity that puts pressure on freight rates to go down.

Devin Burke, CEO of Universal Cargo Management, said:

“…the inability for the P3 to consolidate their capacity and reduce their costs will cause them to have more pressure to raise their rates, or continue to lose billions. As well it makes them desperate to fill all those vessels by enticing with lower rates. So being squeezed at both ends it will force them to find revenue wherever they [can and] the market will bear. I believe overall this will put more downward pressure on the ocean freight going onward, where GRI’s and PSS have no teeth and will never stick, but at the same time see more surcharges implemented (i.e. Chassis surcharges)…, which always ends up falling on the NVOCC’s to bear, rather than large shippers.

We see General Rate Increases and Peak Season Surcharges from carriers all the time to try to get freight rates into profitable margins. But like Mr. Burke gets at in the quote above, it is very difficult for carriers to maintain these kinds of rate increases. The problem is they’re raises for profitability purposes from carriers instead of corresponding with existing supply and demand.

It seems like freight rates may actually get pushed down because of factors like overcapacity. But shipping costs could actually go up as surcharges go up.

Consider the example Mr. Burke pointed out. Chassis fees are hitting shippers in the U.S. after carriers sold their chassis to a third party instead of continuing to provide chassis for U.S. shipments. Chassis surcharges don’t come directly from carriers, but from truckers who now have to rent chassis by the day from the third parties who the carriers sold the chassis to in order to bring in some much needed cash.

You can about guarantee medium to small international shippers will see more surcharges coming directly from the carriers. Perhaps some of the most likely immediate surcharges will be port congestion fees as the ILWU contract negotiations have potential to affect operations at West Coast ports.

As I say farewell to the P3 Network, I open it up to you in the comments section below. What are your thoughts on China saying no to the P3? Are there fallout implications of the P3 that I should have included in this blog but didn’t?

![]()

Source: China