And Then There Were 3… Carrier Alliances

When watching the carriers operating in the international shipping industry, the old Agatha Christie mystery, “Ten Little Indians” comes to mind.

When watching the carriers operating in the international shipping industry, the old Agatha Christie mystery, “Ten Little Indians” comes to mind.

… And then there were three…

If you haven’t read the novel or seen the play or seen the movie adaptation or the other movie adaptation… it’s one of those mysteries where a bunch of people (in this case 10) are trapped together, getting killed off one by one. The countdown is marked by ten little Indian figurines that get broken one after another as the people die. There’s also a little nursery rhyme about the little Indians dying one after another that is probably not very PC (that’s politically correct, not personal computer).

The pool of competition of carriers, or shipping lines, in international shipping is shrinking like Christie’s cast of characters.

In 2011, I first started writing that the number of carriers operating in the international shipping would shrink after they suffered huge losses (measured in billions of dollars) due largely to overcapacity and were likely see much more overcapacity in the upcoming years.

It was then, five years ago, that Maersk CEO Nils Smedegaard Andersen said, “It would be natural if the smaller players in this business, or their banks, start questioning whether it’s a good idea to keep competing.”

Would Maersk, as the big dog of international shipping, just wait out the deaths of its smaller competitors?

Well, overcapacity has continued to plague carriers, and the competition pool has shrunk.

There have been mergers and buyouts, but the biggest way carriers are dealing with overcapacity and struggles to maintain profitability is by forming carrier alliances, also known as vessel sharing agreements.

To avoid being wiped out like the Ten Little Indians, carriers huddle into groups, reducing overhead as they share operating costs in order to make money while overcapacity pushes freight rates down.

But now, after the merging of China’s two big shipping companies, Cosco Container Lines and China Shipping Container Lines, into China Cosco Shipping Corporation and it joining CMA CGM, Evergreen Line, and OOCL to form the new Ocean Alliance, all the old carrier alliances are being broken apart.

All the old alliances except the one at the top. The world’s two largest ocean carriers by capacity, Maersk and MSC, will continue on with their 2M shipping alliance.

That leaves all the rest of the carriers, who are part of the ending Ocean 3, G6, and CKYHE alliances, to scramble together into a new alliance that has just been announced (though not all of them seem to be making it in).

That new alliance is the THE Alliance.

It feels really redundant to type the THE Alliance.

Now, as long as the new alliance configurations gain approval, international shipping will be completely dominated by the 2M, Ocean, and THE alliances.

… And then there were 3…

For an idea of just how dominant these three alliances will be, according to Alphaliner figures found in a JOC article, the three carrier alliances will control 94% of capacity on Asia-North America routes and own 99% of the market share on Asia-Europe routes.

Basically, any carrier not in one of these three alliances looks to be in trouble. APL and Hyundai, I’m looking at you.

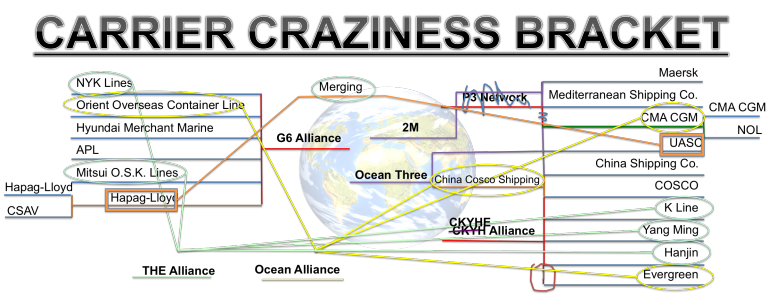

Here’s a quick breakdown of what shipping companies comprise which alliances. First, visually with the Carrier Craziness Bracket (Yes, it’s broken, and yes, I said last time was probably the last time you’d see this bracket, but I did say, “probably”).

Carrier Craziness Bracket updated with Ocean Alliance and THE Alliance

2M

Maersk

Mediterranean Shipping Co.

Ocean Alliance

CMA CGM

China Cosco Shipping Corporation

Evergreen Line

OOCL

THE Alliance

Hapag-Lloyd

Hanjin Shipping

Mitsui OSK Lines

NYK Line

K Line

Yang Ming Marine Transport

UASC (Expected to be included, and in merger talks with Hapag-Lloyd)

So there you have it. The new world order of international shipping.