Merger from Rumors to Reality

To be clear, a merger has not happened yet. But first there were rumors. Then there were confirmed merger talks. It seems all but inevitable that the rankings of the world’s largest shipping companies is about to shift.

To be clear, a merger has not happened yet. But first there were rumors. Then there were confirmed merger talks. It seems all but inevitable that the rankings of the world’s largest shipping companies is about to shift.

Rumor spread that China Ocean Shipping Group Company (COSCO) and China Shipping Group are merging.

Those rumors of merger talks between the state-owned shipping giants put the financial market in an uproar.

On August 7th, the Journal of Commerce (JOC) reported:

The rumor that China’s two main shipping lines, Cosco and China Shipping, planned to merge was again wreaking havoc with the financial markets today as stock prices for the state-owned companies soared enough to lead to a trading halt.

Confirming such news is virtually impossible, but it doesn’t take much to spook China’s jittery financial markets. By the close of trading on the Hong Kong Exchange, Cosco’s share price had risen 13.56 percent and China Shipping Container Line (CSCL) was up almost 24 percent.

A Reuters article on August 11th moves the merger talks from rumor to reality with the halting of trading in the shipping companies’ shares:

The listed units of the two state-owned companies, including COSCO’s flagship ChinaCosco and China Shipping’s China Shipping Development halted trading in their shares from Aug. 10, adding that they were “planning major issues”.

COSCO and China Shipping Co. merging is a big deal. It is only natural to see a big reaction in the financial market at the news, and even rumors, of merger talk.

Gaining from 6 & 7 to 4

The Reuters article reports, “COSCO and China Shipping are currently the world’s sixth and seventh largest container shipping firms, respectively, according to consultancy Alphaliner.”

With a merger, the larger China-owned shipping company would make a significant jump from occupying the sixth and seventh largest shipping company spots to the world’s fourth largest shipping company in the world.

The JOC article projected:

A potential merger would create the world’s fourth-largest single carrier, controlling a good 8 percent of global container shipping capacity. The new entity would be solid on the Asia-Europe trades but would have less share of the market on the other trades.

The COSCO and China Shipping merged company would usurp the world’s fourth largest shipping carrier seat from Hapag-Lloyd, which became the fourth largest carrier by merging with CSAV.

The three largest container shipping companies in the world are Maersk, Mediterranean Shipping Co., and CMA CGM.

Updated Carrier Craziness Bracket

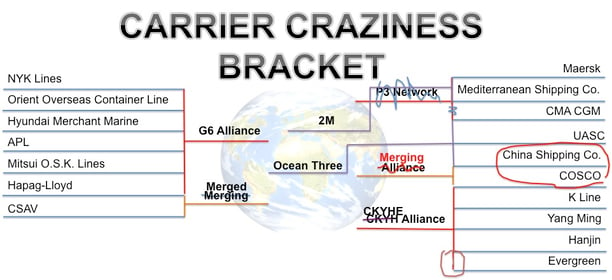

That’s right, I can’t let a major change in the standings of the ocean carriers go without updating my Carrier Craziness Bracket.

The Carrier Craziness Bracket started as a spoof on March Madness brackets to illustrate all the carrier alliances that were happening. Since its creation, the bracket has gotten out of control–broken as many times as your March Madness bracket after you finally decided to put money on it.

It is still easy to see how the world of international shipping carriers is shrinking. The merger between COSCO and China Shipping Co. will be one more step in the ever decreasing number of competitors shipping containers across the oceans.

Chinese Government Driving Force Behind Merger

China is looking to rule international shipping by 2030. China is restructuring, streamlining, merging companies, and allowing a larger private sector role in the country’s economy (and international shipping industry) in order to increase their competitiveness and even dominate globally.

That being said, it is the Chinese government pushing the companies into merger talks.

Reuters reports:

The report said the firms would set up a five-member working group to consider the merger plan, with three members from China Shipping and two from COSCO. China Shipping’s chairman, Xu Lirong, would head the team, it said.

While China is serious about this merger and reform to the state-owned shipping companies, as well as to the private sector of international shipping, this will be no easy task.

The JOC article helps illuminate what a task the Chinese government is undertaking:

… the merger would be driven by the the state-owned Assets Supervision and Administration Commission of the State Council, a powerful authority tasked with the modernization and restructuring of large state-owned enterprises.

… The integrated and complex nature of China’s state-owned shipping ownership structure has resulted in a dizzying maze of companies and subsidiaries, many interconnected and several with dual listings on the Hong Kong and Shanghai exchanges.

Back in 2009, according to the List of International Shipping Operators, the Ministry of Transport approved 214 international shipping companies, about two-thirds of which were state-owned. Some were China-foreign joint ventures and the rest were private firms.

More than 60 of these 214 shipping companies are branches, subsidiaries and joint ventures of the three major state-owned shipping corporations. In fact, in terms of shipping capacity, the three major state-owned corporations comprise 71 percent of the gross tonnage, with 43.5 percent of the capacity held by Cosco alone, according to the Shanghai International Shipping Institute (SISI).

Of course, it always seems that when the Chinese government wants to do something, they make it happen. Don’t expect the complex web of shipping companies and subsidiaries to stop China from achieving this merger and combining COSCO and China Shipping Co. to form the world’s fourth largest carrier.