FMC Halts New Premiere Carrier Alliance & the Carrier Craziness Bracket Is Back!

There’s a big shakeup happening right now with the carrier alliances that dominate global ocean freight shipping, but the Federal Maritime Commission (FMC) may throw a wrench in some of the major ocean carriers’ plans. And I’m here for it.

Let’s get into what’s happening, why it’s part of something that makes me go against my usual stance on government regulatory action, and the return of something no one asked to be brought back…

FMC Pauses Premiere Alliance for Assessment

Three of the world’s major shipping lines – HMM, Ocean Network Express (ONE), and Yang Ming – were set for their new cooperation agreement, the Premiere Alliance, to go into effect this week. However, the FMC halted it to assess potential anti-competitive consequences of the new alliance. World Cargo News reports:

The Premier Alliance of HMM, Ocean Network Express (ONE), and Yang Ming will not come into effect this week as the US Federal Maritime Commission (FMC) has requested additional information to assess the competitive implications of the arrangement.

On 6 December, the FMC issued a Request for Additional Information (RFAI) to obtain verifiable documents necessary for evaluating the Premier Alliance Agreement. The agreement, filed by the three container shipping companies on 28 October, would have become effective on 12 December, 45 days after its filing, had the commission not intervened.

…

The FMC determined that the Premier Alliance Agreement as submitted lacked sufficient detail to allow a complete analysis of potential competitive impacts and whether the arrangement complies with all statutory requirements. A 15-day public comment period will open once the RFAI notice is published in the Federal Register later this week.

Competition in Ocean Shipping

I’m happy to see the government telling shipping lines to slow their roll on this carrier alliance. However, I think there’s a better than good chance the Premiere Alliance still happens after the FMC completes its assessment. I’d actually like to see the FMC consider removing its approval from all the carrier alliances.

That seems like a strange stance coming from me, as I tend to be a smaller government, fewer regulations, less regulatory action kind of guy, particularly when it comes to business and the economy. Still, for years I’ve argued the FMC should rethink carrier alliances because I believe they’re part of a larger picture of competition reduction in the international shipping industry.

Soon after I first started writing about international shipping all the way back in 2011, I saw how ocean freight carriers were struggling with overcapacity, unsustainably low freight rates, and incredible losses. For shippers, things seemed good. Cheap freight rates meant lower costs and higher bottom lines. Business was good.

Of course, business was not good for shipping lines. Over the next several years, freight rate wars, overcapacity, billion-dollar losses, mergers, buyouts, and even bankruptcy hit the industry, shrinking carrier competition. Among strategies or trends to increase profits, like larger container ships and slow-steaming, came vessel sharing agreements or carrier alliances. Vessel sharing agreements represented significant cost savings for carriers but also espoused shrinking competition.

That narrowing of competition worried me. It takes little economic understanding to know competition brings better service and price points to industries. Carrier cooperation with each other, in my mind, meant less competition and higher freight rates for shippers who would likely experience less cargo arrival reliability among generally poorer service from shipping lines.

Of course, carriers in alliances are only supposed to cooperate in sharing vessels, not in sales or pricing. But knowing the industry to have a long history with antitrust violations and for general rate increases (GRI) to often drop in a rather synchronized-looking fashion from shipping lines, I had my doubts that carriers would manage to strictly follow only cooperating with vessel sharing when working together. But that wasn’t even my biggest concern.

My larger concern was that the major carriers all working together in just a handful of alliances that dominate the industry could potentially manipulate the ocean shipping’s supply/capacity. Overcapacity had been a problem for them for years, but unnatural, cooperative capacity control over the industry through alliances could push freight rates beyond just healthy for carriers to business-wreckingly high for shippers. This really come to fruition when the pandemic hit. Initially, carriers were worried about a reduction of demand. With their alliances, they blanked (canelled) hundreds of sailings, reducing capacity way below demand. Then when the demand spiked, freight rates skyrocketed to new records. Plus, containers and equipment were maldistributed around the world, adding more complication to a situation that was already more than anyone was ready to handle.

Since at least 2014, I’d been raising my concerns about carrier alliances. By 2016, I was calling on maritime regulators to reconsider vessel sharing agreements.

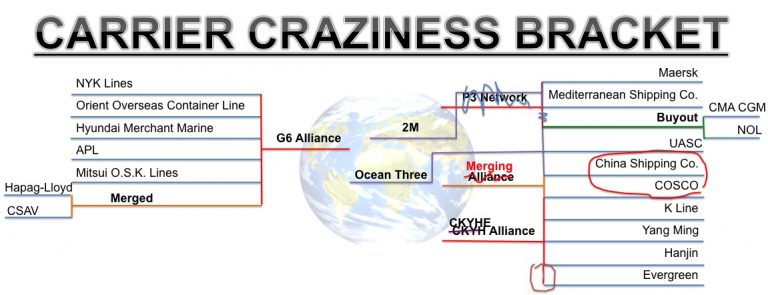

It’s not as though vessel sharing agreements never existed before this point, but they had not happened to the level they happened in the early to mid 2010s. Carriers saw aligning themselves into big vessel agreements with other major carriers as a necessity to survive in the market. By the midpoint of 2016, all of the world’s major shipping lines clumped into three alliances – 2M, THE Alliance, and Ocean Alliance.

For the better part of a decade, those three alliances dominated the world’s ocean shipping. Then, last year, after what seemed to be years of growing contention between MSC and Maersk, the world’s two largest ocean carriers by capacity announced they were going to end their 2M alliance. That surely meant a big shakeup for carrier alliances.

At the beginning of this year, Hapag-Lloyd left the THE Alliance to join Maersk in their Gemini Cooperation (Gemini). THE Alliance members said it would be “business as usual,” but while the THE Alliance continues on, its remaining members created the new Premiere Alliance. Most assume that will mean the end of THE. But now there’s also uncertainty for the future of Premiere.

These big carrier alliance events made me decide to dust off and update…

Universal Cargo’s Carrier Craziness Bracket

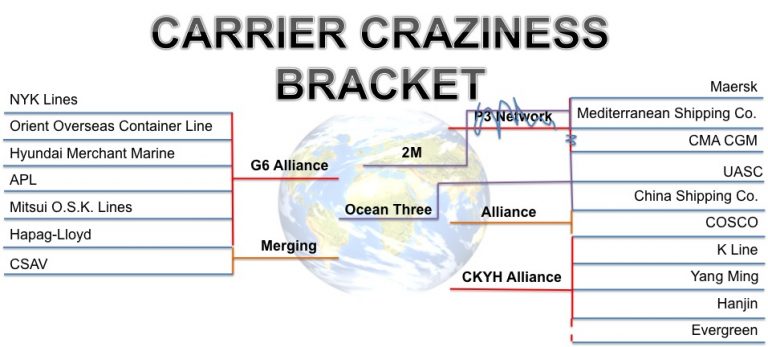

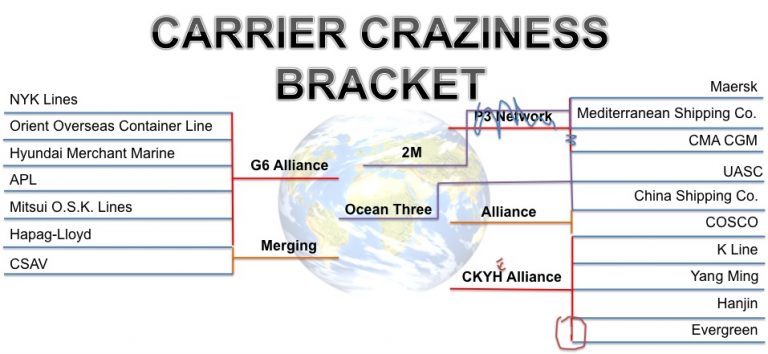

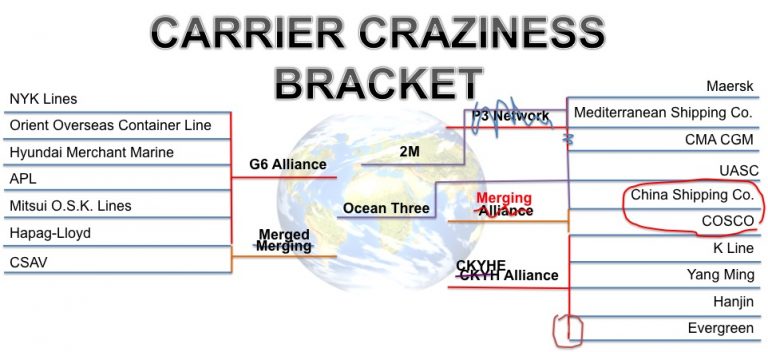

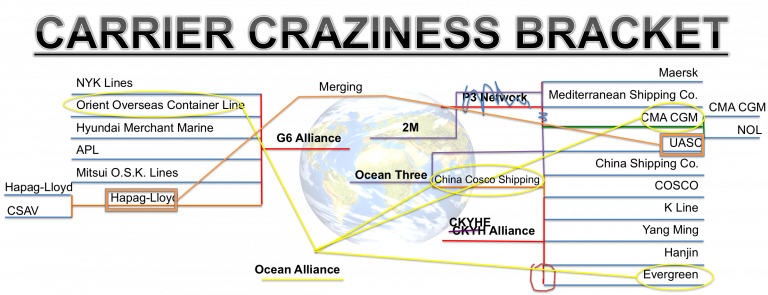

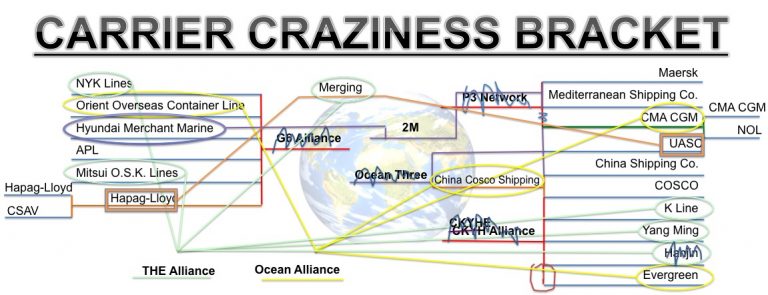

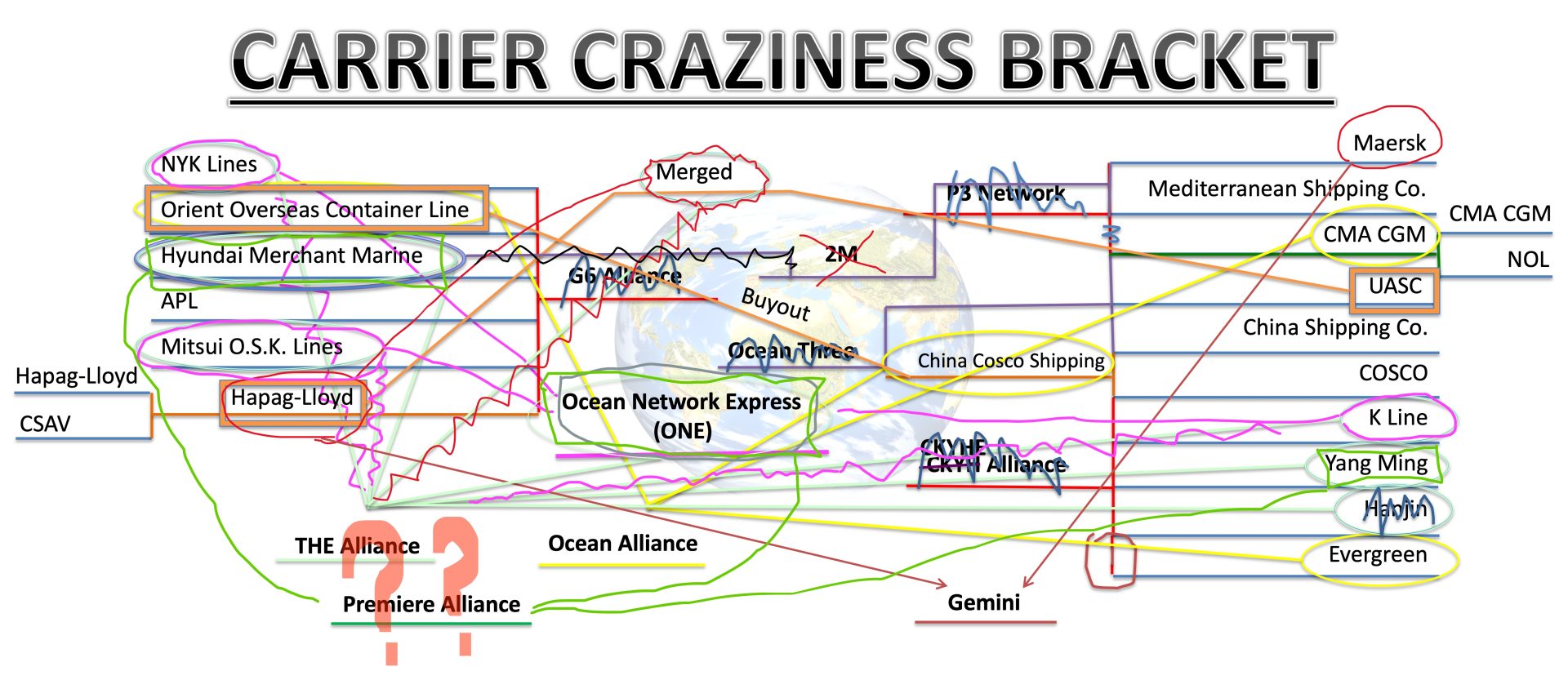

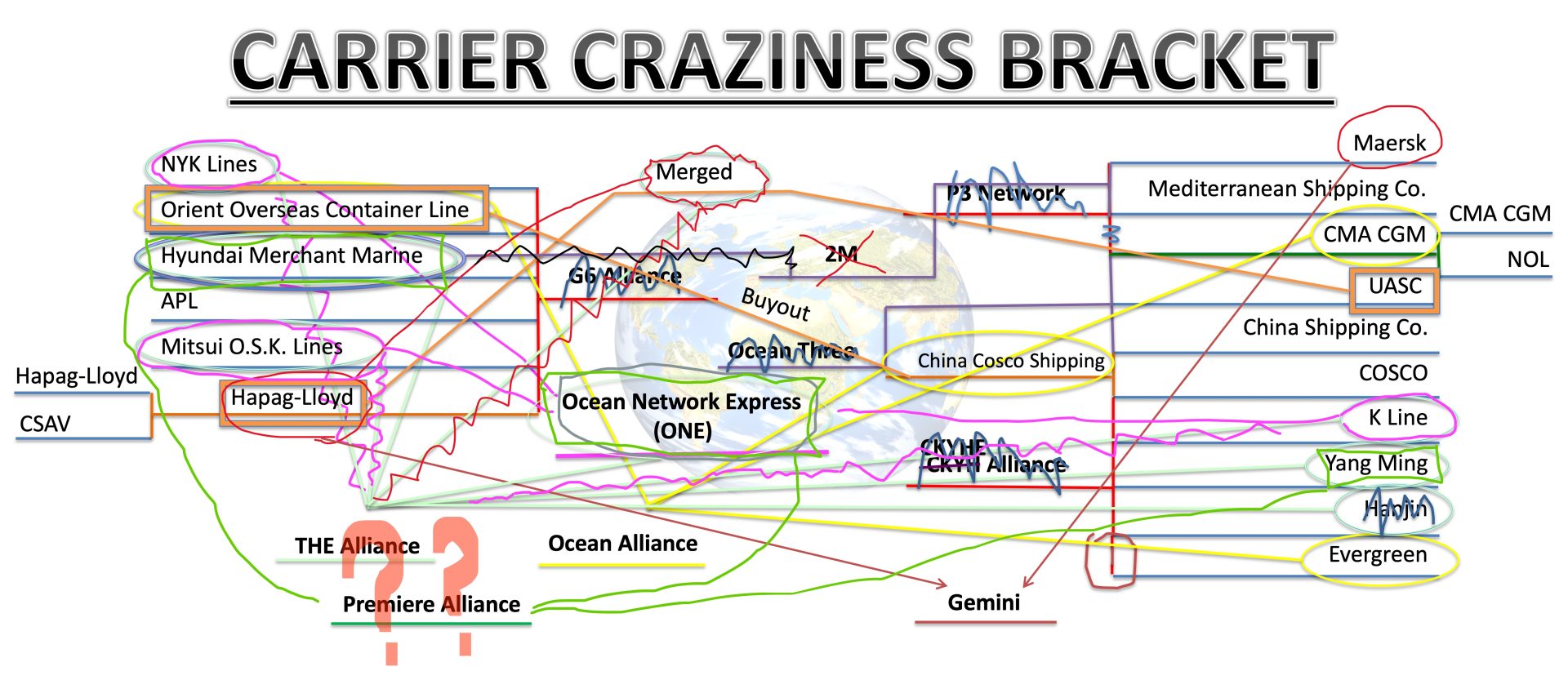

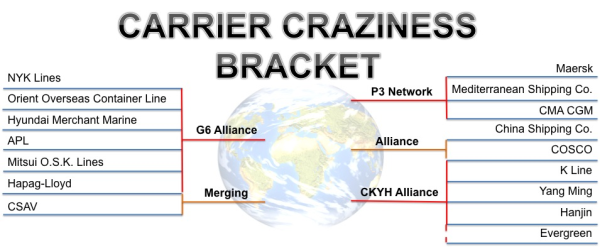

You didn’t ask for it. You probably didn’t even want it, but here’s an updated version of Universal Cargo’s old Carrier Craziness Bracket, which illustrates the ocean freight’s shrinking carrier competition:

To the average person, the Carrier Craziness Bracket above just looks like a complete mess. And that person wouldn’t be wrong. At all.

But the Carrier Craziness Bracket didn’t always look this way.

Inspired by March Madness tournament brackets, the Carrier Craziness Bracket first came to be in April of 2014. Then, it neatly showed competition for shippers’ ocean freight, mostly through carriers joining in alliances but also through a merger, narrowing.

Then that narrowing turned to crazy competition shrinkage, with mergers, buyouts, bankruptcy, and an insane amount of alliance shuffling.

Keep in mind, not every little merger or buyout made it into the Carrier Craziness Bracket, and there are probably at least a few renditions of the bracket that won’t be included here, but…

… Just for fun, let’s relive the carrier competition’s decent into madness with Universal Cargo’s messier and messier updates over the years to its Carrier Craziness Bracket: