Steel & Stealing – Chassis Thefts at Port of L.A. & Trump’s New Tariffs

Criminal Arrest & Recovery of Stolen Chassis from the Port of L.A.

There’s been a criminal organization infilitrating the Port of Los Angeles. Its illegal operations have included stealing chassis from the port, refurbishing them, and selling them as new. However, the LAPD and Los Angeles Port Police put a serious dent in the criminal operation, arresting a suspect in connection with the crimes and recovering over half a million dollars worth of chassis.

Officers with the Los Angeles Port Police Criminal Investigation Section, along with the Los Angeles Police Department Commercial Crimes Unit, arrested a suspect in connection with multiple occurrences of stolen chassis throughout the Port of Los Angeles. The suspect was arrested during an investigation that led officers to a facility in Gardena, Calif., where they were also able to recover 24 suspected stolen chassis worth around US$600,000.

According to the article, the investigation has been ongoing for months, and it actually uses the plural “criminal organizations” that have been stealing, refacing, altering, and selling the chassis as new. The article reports the revenue made by these criminal organizations is estimated to be in the millions.

Chassis are obviously an extremely important part of international shipping. When the industry struggles with equipment shortages or maldistribution of chassis and/or shipping containers, it puts significant upward pressure on freight rates and shipping costs for importers and exporters. Such equipment maldistribution played a significant role in spiking freight rates and congestion when the pandemic hit.

Trump’s New 25% Tariff on Steel & Aluminum

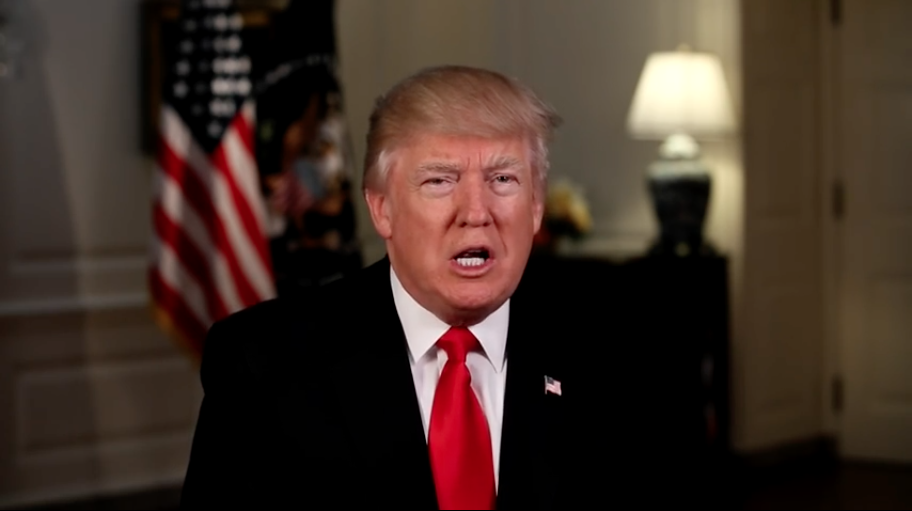

President Trump announced that the U.S. will impose 25% tariffs on all steel and aluminum imports.

Previously, there had been 25% tariffs on steel, but many countries, including Canada and Mexico, were exempt. Exempt countries also included Argentina, Australia, Brazil, Japan, South Korea, the European Union, Ukraine, and the United Kingdom These exemptions created loopholes for dumping steel into the U.S.

Broadly placing the 25% tariffs on all steel, removing country exemptions and upping standards to close other loopholes creates a true 25% tariff on steel. On the aluminum side, this is a tariff increase. The Trump Administration points to President Trump’s placement of a 10% tariff on aluminum (along with a 25% tariff on steel) as an example of success with these kinds of tariffs aiding U.S. industry.

The administration also points to loopholes and exemptions as weakening the program.

Here’s the full release from the White House regarding this new tariff announcement:

Fact Sheet: President Donald J. Trump Restores Section 232 Tariffs

COUNTERING TRADE PRACTICES THAT UNDERMINE NATIONAL SECURITY:

Yesterday, President Donald J. Trump signed proclamations to close existing loopholes and exemptions to restore a true 25% tariff on steel and elevate the tariff to 25% on aluminum.

- President Trump is taking action to protect America’s critical steel and aluminum industries, which have been harmed by unfair trade practices and global excess capacity.

- President Trump is reinstating the full 25% tariff on steel imports and increasing tariffs on aluminum imports to 25%.

- Key reforms include eliminating all alternative agreements, applying strict “melted and poured” standards, expanding tariffs to include key downstream products, terminating all general approved exclusions, and cracking down on tariff misclassification and duty evasion schemes.

- The countries of Argentina, Australia, Brazil, Canada, Japan, Mexico, South Korea, the European Union, Ukraine, and the United Kingdom had received exemptions, which prevented the tariffs from being effective.

- By granting exemptions to certain countries, the United States inadvertently created loopholes that were exploited by China and others with excess steel and aluminum capacity, undermining the purpose of these exemptions.

- The President is exercising his authority under Section 232 of the Trade Expansion Act of 1962 to adjust imports of steel and aluminum to protect our national security.

- This statute provides the President with authority to adjust imports being brought into the United States in quantities or under circumstances that threaten to impair national security.

- In March 2018, President Trump invoked authority under Section 232 of the Trade Expansion Act of 1962 (19 U.S.C. § 1862) to impose 25% tariffs on steel imports and 10% tariffs on aluminum. These measures were remarkably effective in supporting recovery and reinvestment in the American steel industry and saved the domestic primary aluminum industry from total collapse. But exemptions and loopholes have permitted evasion of the tariffs and weakened the effectiveness of the program.

- The reinvigorated Section 232 tariffs on steel and aluminum will support the program’s original objective of revitalizing the domestic steel and aluminum industries and achieving sustainable capacity utilization of at least 80%.

RESTORING FAIRNESS TO STEEL AND ALUMINUM MARKETS:

President Trump is taking action to end unfair trade practices and the global dumping of steel and aluminum.

- Foreign nations have been flooding the United States market with cheap steel and aluminum, often subsidized by their governments.

- A report from the first Trump Administration found that steel import levels and global excess were weakening our domestic economy and threatening to impair national security.

- The report found that excess production and capacity, particularly in China, has been a major factor in the decline of domestic aluminum production.

- While the domestic steel industry briefly achieved 80% utilization in 2021, subsequent trade pressure following the COVID-19 pandemic has depressed domestic production. In 2022 and 2023, capacity utilization fell to 77.3% and 75.3%, respectively. High import volumes from sources exempt from Section 232 tariffs are a major factor in depressing domestic production volumes.

- For aluminum, there was an increase in the capacity utilization rate between 2017 and 2019, from 40% to 61% during that period. But since 2019, the aluminum capacity utilization has once again seen a steady decline, falling from 61% to 55% between 2019 and 2023.

- The United States does not want to be in a position where it would be unable to meet demand for national defense and critical infrastructure in a national emergency.

STRENGTHENING AMERICA’S MANUFACTURING INDUSTRY:

President Trump’s decision to close existing loopholes and exemptions will strengthen United States’ steel and aluminum industries.

- In his first term, President Trump imposed Section 232 tariffs to protect the American steel and aluminum industries from unfair foreign competition.

- The steel tariffs that President Trump implemented led to thousands of jobs gained and higher wages in the metals industry.

- These tariffs were hailed as a “boon” for Minnesota’s iron ore industry, with state officials crediting tariffs for bolstering the local economy.

- Steel and aluminum imports drastically decreased under President Trump, falling by nearly a third from 2016 to 2020.

- The tariffs led to a wave in investment across the United States, with more than $10 billion committed to build new mills.

- It was recently announced that Hyundai Steel is actively considering building a steel plant in the United States.

- U.S. steelmakers, including the American Iron and Steel Institute and the Steel Manufacturers Association, have praised President Trump’s America First trade policy.

TARIFFS WORK:

Studies have repeatedly shown that contrary to public rhetoric, tariffs can be an effective tool for achieving economic and strategic objectives.

- A 2024 study on the effects of President Trump’s tariffs in his first Administration found that they “strengthened the U.S. economy,” and “led to significant reshoring” in industries like manufacturing and steel production.

- A 2023 report by the U.S. International Trade Commission that analyzed the effects of Section 232 and 301 tariffs on more than $300 billion of U.S. imports found that the tariffs reduced imports from China, effectively stimulated more U.S. production of the tariffed goods, with very minor effects on prices.

- According to the Economic Policy Institute, the tariffs implemented by President Trump during his first Administration “clearly show[ed] no correlation with inflation” and only had a temporary effect on overall price levels.

- An analysis from the Atlantic Council found that “tariffs would create new incentives for US consumers to buy US-made products.”

- Former Biden Treasury Secretary Janet Yellen affirmed last year that tariffs do not raise prices: “I don’t believe that American consumers will see any meaningful increase in the prices that they face.”

- A 2024 economic analysis found that a global tariff of 10% would grow the economy by $728 billion, create 2.8 million jobs, and increase real household incomes by 5.7%.